A new Board of Supervisors resolution, to be introduced today, would add the Dakota Access Pipeline to the list of social issues the city must consider when choosing the banks with which it invests its money.

District 1 Supervisor Sandra Lee Fewer and District 9 Supervisor Hillary Ronen, who were both elected to their seats for the first time this fall, are introducing the resolution, which urges city treasurer Jose Cisneros to add considerations of banks' support for the Dakota Access Pipeline to the city’s Socially Responsible Investment Matrix.

"My decision to introduce this resolution is grounded in my belief that the pipeline construction is a violation of human rights, and a degradation of the natural environment," Supervisor Fewer said in a press release today.

Last November, the Board unanimously passed a resolution opposing the pipeline and supporting the cause of the Standing Rock Sioux tribe. Now, activists are hoping the city will put its money where its mouth is, by divesting from banks that support the pipeline.

At least two U.S. cities—Seattle, Wash., and Davis, Calif.—have divested their money from Wells Fargo, at least in part due to its financing of the pipeline. Other cities, including Boulder, Minneapolis, Philadelphia and Portland, Ore., are reportedly considering similar measures.

As we reported last week, the city weighs its investment portfolio against the Socially Responsible Investment Matrix each month. The matrix is typically updated annually, and the treasurer’s office told us last week that Cisneros was already considering adding the DAPL to the matrix during its next review in October.

If passed, Fewer and Ronen's resolution would speed up this process, adding language that would discourage the city from investing in entities that finance crude oil infrastructure projects, said Jackie Fielder, spokeswoman for the San Francisco Defund DAPL Coalition.

The resolution is in large part the result of pressure from the coalition, which held an action at last week's Board meeting to highlight the urgency of divesting city finances from the controversial pipeline.

The resolution "urges the City Treasurer to update the socially responsible investment matrix by adding the Dakota Access Pipeline as a screening factor, and to move with expediency in exploring divestments from issuers that do not meet the socially responsible investment criteria, as updated," said Chelsea Boilard, a legislative aide with Fewer's office.

If the resolution passes, the coalition says it will continue pressuring the treasurer until divestment occurs.

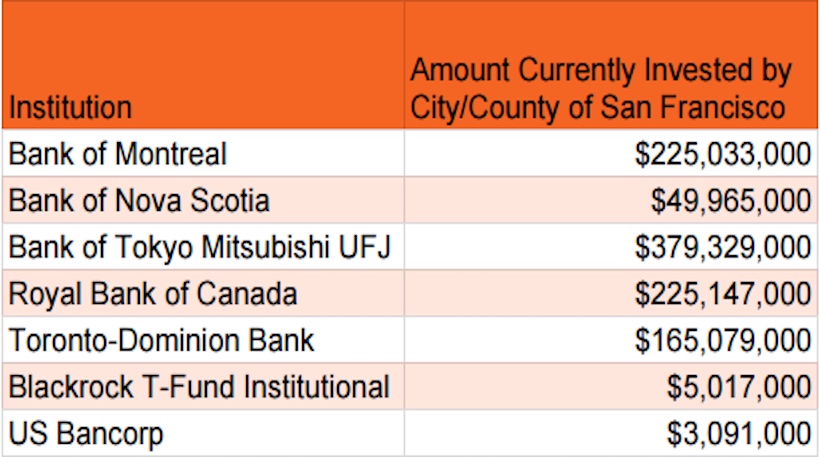

Should the legislation pass, it could have a significant effect on the city's investment structure. As a representative for the Treasurer's office told us last week, $1.052 billion, or roughly 12.6 percent, of San Francisco's $8.3 billion in assets is invested with institutions that are helping to fund the pipeline.

If passed, Fielder said the resolution would also direct the city's Budget & Legislative Analyst to report on alternatives to Bank of America, which handles some of the city's commercial banking.

San Francisco’s contract with Bank of America is set to end in August 2018, according to the coalition. Its aim is to see the city forge a new contract with a bank that not only does not have ties to the pipeline, but is also more local, such as Westamerica Bank, Sterling Bank & Trust or Mechanics Bank.

Previously, the coalition had been lobbying for an ordinance that would have prohibited cash management contracts with the institutions that are bankrolling DAPL.

"While it is not our original ask, it will help us in our ultimate push to persuade more fiscally conservative Supervisors that this is a viable idea," said Fielder.

The resolution must receive unanimous support from the Board to pass, so the coalition is encouraging those who oppose the DAPL to call or write their Supervisors ahead of a vote on the resolution, which will occur next Tuesday, March 14th, at 2pm.

-1.webp?w=1000&h=1000&fit=crop&crop:edges)