In a push to tackle the housing crisis head-on, Portland's Metro Bond Opportunity Solicitation is beckoning developers to roll out their blueprints. Known colloquially as "M-BOS Last Gap Round 2," this spring initiative is laying down the gauntlet with a clear target: erect affordable homes, specifically those within reach of the city's lowest earners and homeless populations.

First approved by voters back in November 2018 through Measure 26-199, this groundbreaking regional bond entrusted Metro to issue up to $652.8 million. Looming over this financial effort, the stark aim is to construct no fewer than 3,900 affordable homes, offering a lifeline to those entrenched at the bottom of the economic ladder. Bracing for a boost in affordable living spaces, Metro Bond mandates that at least 1,600 of these units must be clutched within the grasp of households earning 30% or less of the area median income (AMI).

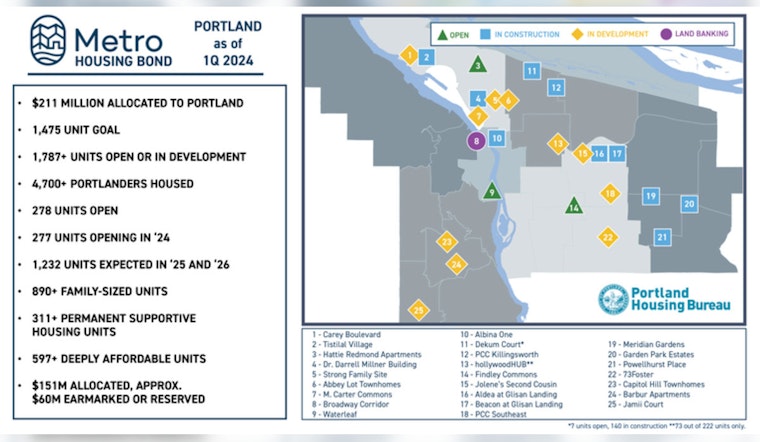

Guided by the Portland Housing Bureau, the City of Portland's implementation of the Metro Bond is not just a numbers game. The strategy, carved out from public engagement, rests on four pillars: lead with racial equity, create opportunity for those in need, distribute investments across the region, and ensure transparency as well as wise use of taxpayer dollars. As per the official announcement, the city's chunk of the bond – around $211 million – is allocated to raise at least 1,475 units. Housing policymakers are looking to cast their nets wide to haul in projects ripe for construction or the acquisition of existing unregulated properties.

Doling out the funds, the M-BOS is brandishing a purse that includes up to $20 million in capital, combining the bread and butter of Metro Housing Bond allocations with other resources such as Multnomah County general funds and the Portland Clean Energy Fund. Seeking those projects that are ready to dive into construction or acquisition, they've laid certain terms: Affordable rent projects must include 30% AMI units, and/or supportive housing units, while affordable homeownership schemes along with land-banking pitches get a cold shoulder as not eligible for the award under this round.

Aiming to fuel the construction engines by the twilight of 2024, the cap of $20 million, which doesn't fold in the money from the Portland Clean Energy Fund – is further broken down. It branches out into over $8 million earmarked from the Metro Housing Bond for properties off the affordability grid, plus nearly $5 million coughed up by Multnomah County for projects aligning with the 30% AMI or Supportive Housing thresholds.