Columbus-based insurance company Root Insurance has secured $350 million in Series E funding, according to company database Crunchbase, topping the city’s recent funding headlines. The cash infusion was announced Aug. 20 and led by DST Global.

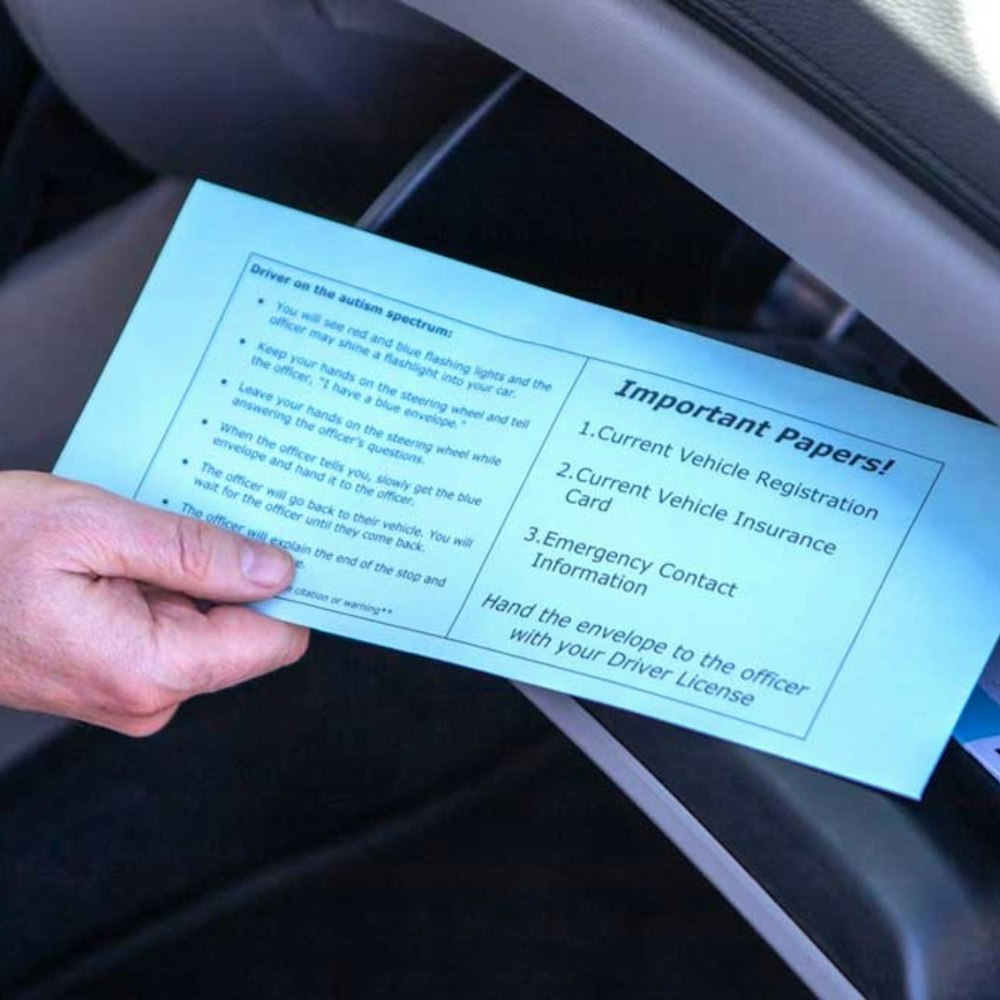

According to its Crunchbase profile, "Root is a car insurance company founded on the belief that people who drive well are less likely to get into accidents, and that those people should pay less for insurance. With that in mind, Root set out to reinvent a broken industry, an industry that was still assigning rates based primarily on demographics and had an archaic agent structure. Using technology in smartphones to measure driving behavior such as braking, speed of turns, driving times and route regularity, Root determines who is a safe driver and who isn't."

The 4-year-old company has raised four previous funding rounds, including a $100 million Series D round in 2018.

The round brings total funding raised by Columbus companies in financial services over the past 90 days to $405 million, an increase of $404 million from the previous three-month period. The local financial services industry has produced four funding rounds over the past year, yielding a total of $505 million in venture funding.

In other local funding news, Sermonix Pharmaceuticals announced a $26 million Series A funding round on July 31, led by WILD Family Office.

According to Crunchbase, "Sermonix Pharmaceuticals LLC, a specialty pharmaceutical company, focuses on the development and commercialization of late-stage women’s health products. It offers lasofoxifene, a selective estrogen receptor modulator for the treatment of vulvovaginal atrophy, as well as treatment and prevention of post-menopausal osteoporosis. The company was founded in 2014 and is headquartered in Columbus, Ohio."

The company also raised a $1.5 million round in 2016.

This story was created automatically using local investment data, then reviewed by an editor. Click here for more about what we're doing. Got thoughts? Go here to share your feedback.