Property owners in Arlington, Texas, have been given a heads-up: the clock is ticking for those looking to challenge their 2024 residential property tax appraisals. The deadline to submit a protest with the Tarrant Appraisal Review Board is set for May 15. A recent notice by the City of Arlington, Texas, emphasizes the importance of reviewing appraisal accounts well before the cut-off date.

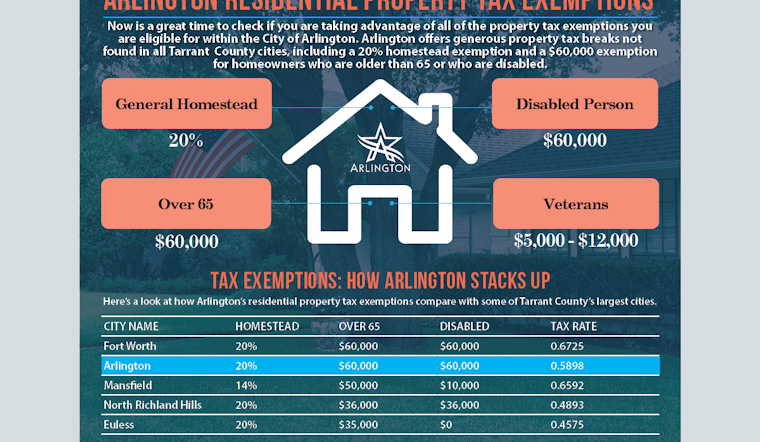

It's worth noting that the May 15 deadline isn't just for tax protests - it's also the last call for homeowners to file for a bevy of property tax exemptions. An oversight could mean missed savings, especially since there's a variety of exemptions on offer. These include a substantial 20% homestead exemption on property value. Seniors and disabled veterans stand to benefit from significant exemptions as well, with a dedicated $60,000 exemption each, alongside surviving spouses of fallen U.S. Armed Forces members and first responders.

To assist residents, the Arlington City Council has kept its commitment to tax relief by authorizing an array of exemptions. The city boasts the largest homestead exemption allowed by Texas law at 20%, which can lead to substantial savings. For instance, if a home is appraised at $200,000 and qualifies for the exemption, the owner would only pay City of Arlington taxes as though the property was valued at $160,000. This is just one of how Arlington homeowners received more than $5.6 billion in tax relief last year, as per the release from the city.

Arlington has also actively taken measures to address the burden of rising property values. Last year's decision by the Council to lower the city's property tax rate for the eighth consecutive year to $0.5898 per $100 of assessed value is indicative of this approach. This change, aimed at providing tax relief, comes at a time when property values see a continuing surge. The city's rate accounts for about 20 to 25% of a property owner's total tax bill, with variations depending on the school district.

For those interested in applying for exemptions or looking into the property tax protest and appeal procedures, all pertinent information is readily available on the Tarrant Appraisal District's website. There's no fee to file for a homestead exemption, a nugget worth noting for thrifty homeowners. Help and further clarification can be sought from a Tarrant Appraisal District Exemptions Specialist at (817) 284-4063, Monday through Friday, or assistance in Spanish at the same number. Property owners who look to take advantage of these opportunities should act fast lest they miss the chance for a potential tax reprieve.