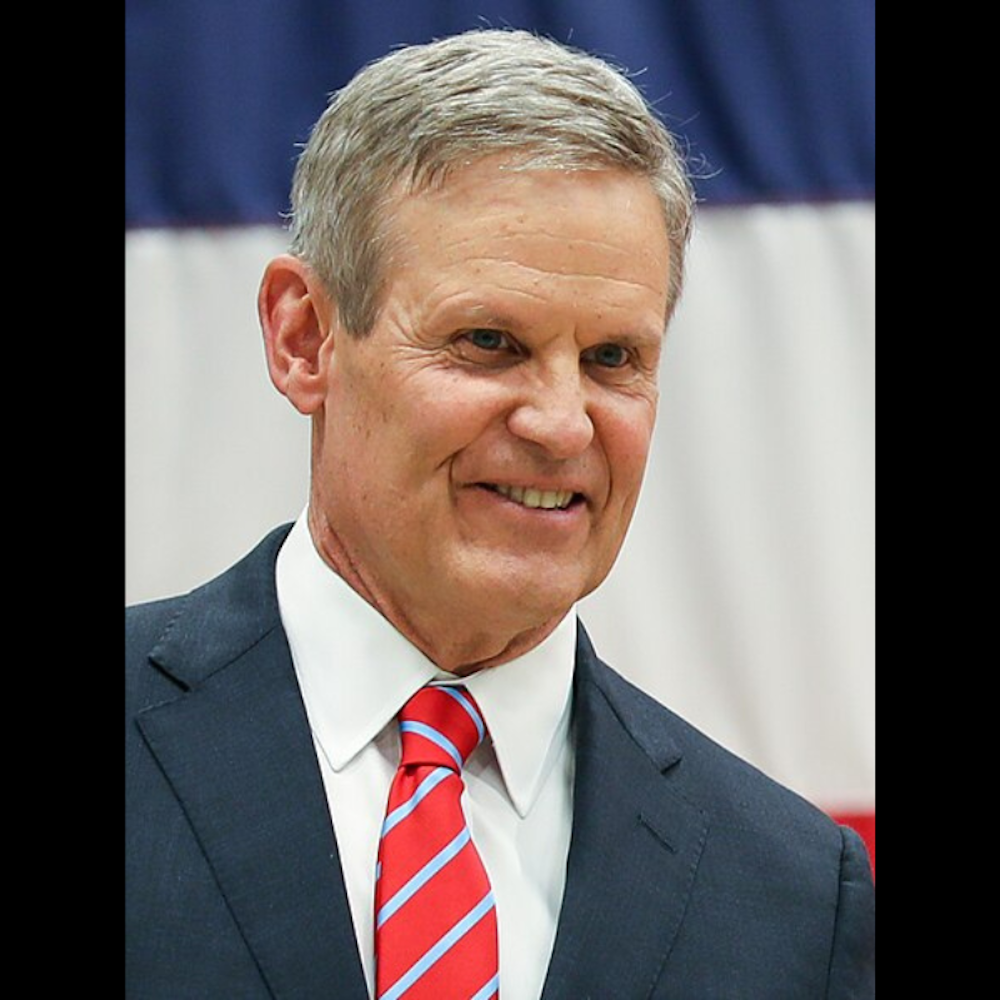

Georgia Attorney General Chris Carr is spearheading a bipartisan charge against the Biden administration's latest student loan repayment scheme. Carr, along with his counterparts from Arkansas, Florida, Missouri, North Dakota, Ohio, and Oklahoma, have launched a 62-page lawsuit to halt President Biden's new debt relief efforts. The group of attorneys general filed the suit on Tuesday, calling into question the constitutionality of Biden's student loan plan, as reported by FOX 5 Atlanta.

"Despite the Court having already settled this issue, the Biden administration continues to brazenly violate the law," Carr was quoted saying in a news release. The lawsuit leverages the precedent set by a previous Supreme Court decision that axed Biden's first plan as unconstitutional. The coalition of states alleges the new plan not only imposes an unfair tax burden on many but also hampers the states' capacity to retain public service employees and impacts state revenue, according to 11Alive.

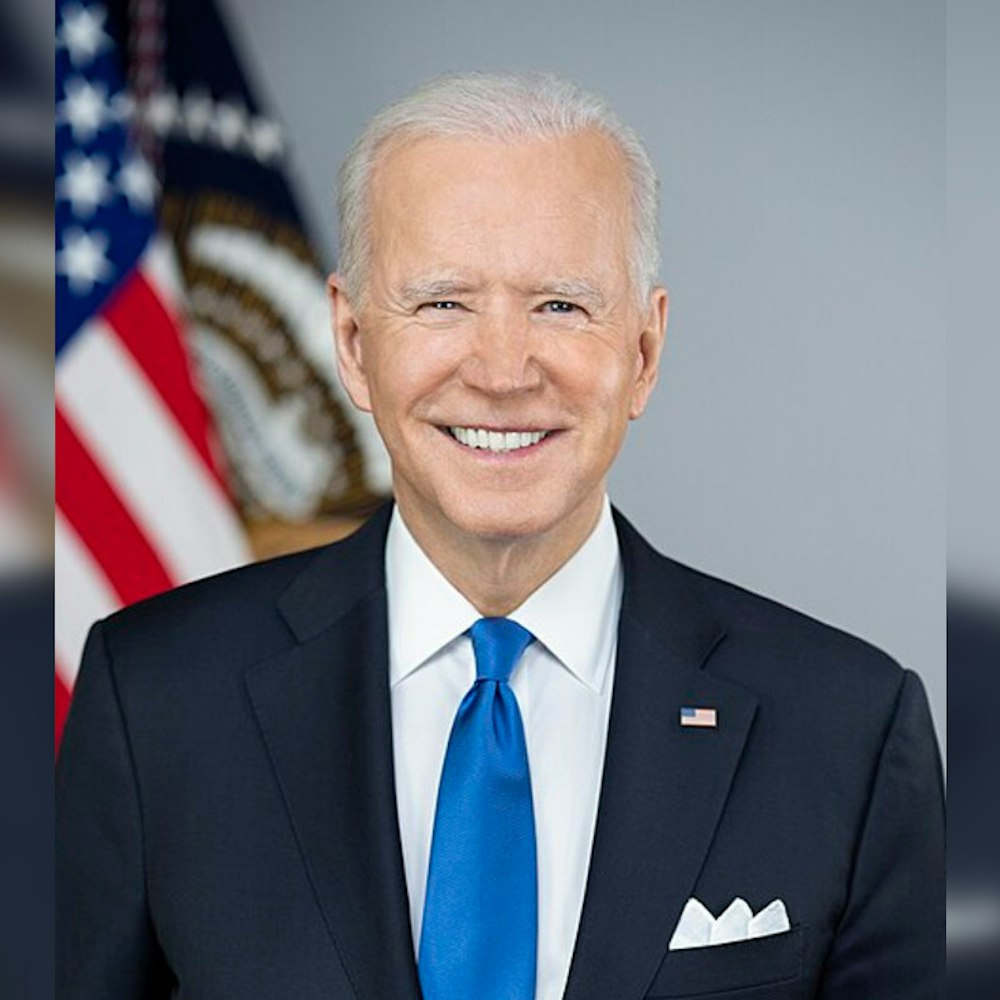

The Biden administration's latest proposal, intended to provide relief to over 30 million Americans, comes on the heels of the scrapped $20,000 loan forgiveness plan intended for more than 40 million borrowers. Details on how the latest loan relief plan will roll out remain unclear, but the Education Department has signaled intentions to issue a formal proposal in the near future, with some elements of the plan possibly coming into effect this fall.

However, pushback from Republicans is steadfast as they contest that the debt forgiveness will result in a greater financial load for taxpayers. So far, Biden has managed to scrub approximately $146 billion in student debt for four million Americans. His administration has outlined various eligibility requirements for borrowers seeking relief under the latest efforts. Among those who may qualify are individuals who have been in repayment for more than 20 years, those enrolled in low-financial-value programs, those experiencing financial hardship, and those fitting into specific categories under the SAVE and PSLF programs, as detailed by both FOX 5 Atlanta and 11Alive.