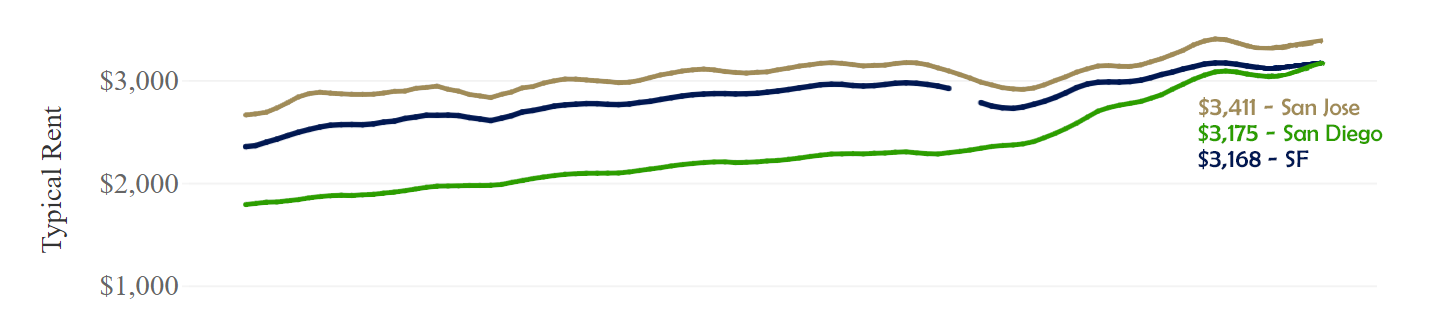

As rental prices across the nation continue to rise at a steady pace indicated in June's report, San Jose holds onto its top spot as the most expensive major market, reported by Zillow today. The typical monthly rent observed in San Jose is now $3,411. Their is a shifting balance between San Diego and San Francisco.

As the ink dries on the June 2023 Rent Report by Zillow, San Diego's rental prices have officially surpassed those in San Francisco for the first time, marking a substantial change in California's rental landscape. San Diego now boasts typical rent prices of $3,175, overtaking San Francisco's $3,168, a stark contrast to February 2020 when San Francisco's rental prices were 29% higher than its southern counterpart. The New York City metro area, at $3,405, is also closely trailing San Jose.

(Data: Zillow)

(Data: Zillow)

Beyond these new developments, the battle of the rental markets scrapes on in the face of an average 0.6% increase in rents, as noted by the Zillow Observed Rent Index (ZORI).

June's 2023 rental growth patterns hold a mirror to pre-pandemic data averaged from 2015-2019. With the impact of these hectic times finally ebbing in the rental market, the focus now shifts to emerging markets – prominently seen in the Northeast and Midwest, where annual rent growth is the highest, such as Boston (7.0%), Hartford (6.9%), Providence (6.9%), Cincinnati (6.8%), and Chicago (6.3%).

Moving out West, the picture becomes slightly dimmer with some of the weakest year-over-year rent growth observed in cities like Las Vegas (down 1.8%), Austin (down 0.8%), Phoenix (0.2%), Seattle (1.0%), and San Francisco (1.2%). The mixed bag of winners and losers in the west can be traced back to various factors such as tech industry hiring weaknesses and the earlier pandemic-era exodus of remote workers.

With the annual growth rate having slowed down to 4.1% from its record-high 16.2% in February 2022, industry experts fortunately are eyeing an ongoing sluggishness. This can be attributed to the rising vacancy rates in rental housing and the towering 978,000 multi-family housing units under construction in May, expected to saturate the market within the next one to two years.