Crunching the numbers for your golden years just got a bit less mysterious, thanks to a recent breakdown by the Arizona State Retirement System (ASRS). For many, pension calculations seem like a black box, but as outlined by the ASRS on their website, it's more of an arithmetic matter than a guessing game. The magic formula is a blend of your average monthly compensation (AMC), service credit, and a graded multiplier, according to the ASRS.

For those scratching their heads at the prospect to early retire, your AMC is the first figure to get cozy with. To calculate your pension, the ASRS examines your last decade of contributions, honing in on the highest consecutive 60 months of your paycheck for members who joined post-7/1/2011, or 36 months for the more seasoned personnel. This was explained in an article recently which was forwarded retirees towards their Retirement Eligibility page for more detailed intel on the subject.

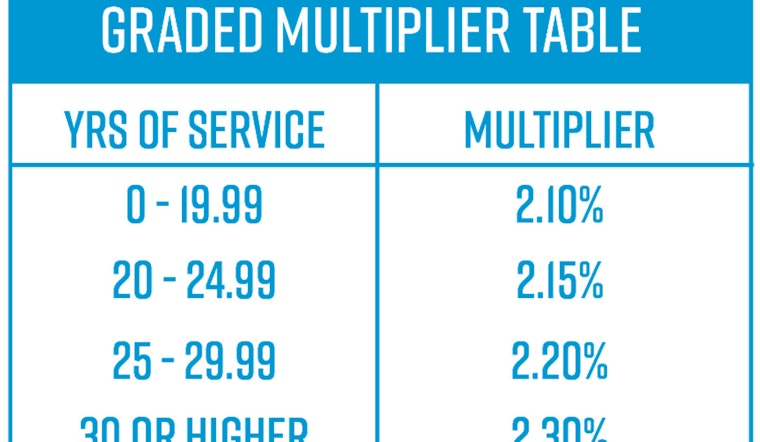

The puzzle's final piece is the so-called 'graded multiplier.' Each year served ups the ante on your multiplier, and by extension, your retirement wage. "As you accrue more service, you qualify for a higher multiplier of your final average monthly compensation, which increases your benefit," as per the ASRS. They encourage soon-to-be retirees to potentially push a little longer on the job especially if they're on the cusp of a higher multiplier threshold.

Before you start circling dates on the calendar, the ASRS suggests utilizing the personalized benefit estimator tool, accessible via your secure myASRS account. This feature allows members to plug and play with retirement scenarios to best determine when to trade in their day job for a hammock. Functionality allows for viewing general estimates or getting down to brass tacks with a tailored estimate.