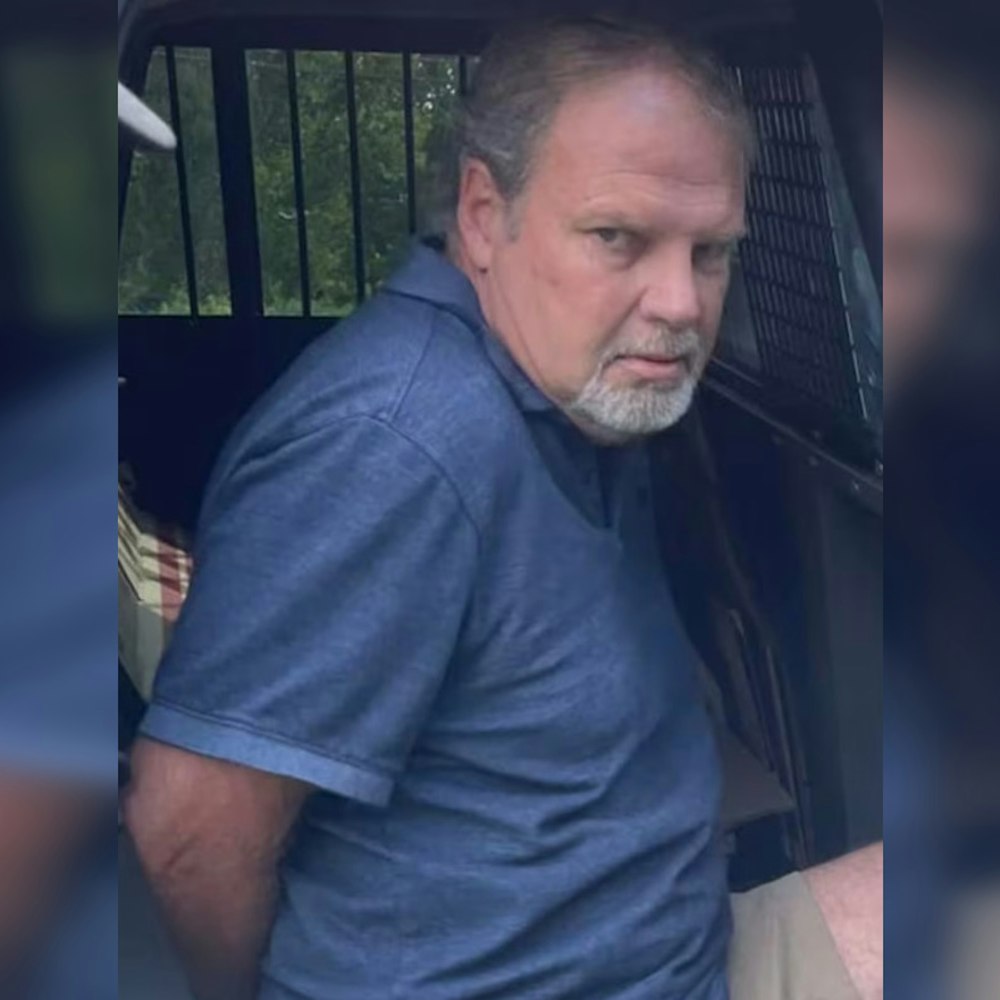

James Arthur McDonald Jr., previously a fixture on financial news shows and a recent fugitive presence, was apprehended this past weekend in Port Orchard, Washington, as stated by a press release from the U.S. Attorney’s Office. Making his initial court appearance today in Tacoma, McDonald faces a multitude of charges following an indictment that includes securities fraud, wire fraud, and investment adviser fraud, among others.

McDonald's alleged transgressions span back to late 2020 at Hercules Investments LLC, where as CEO and CIO, he made highly speculative market moves that resulted in sizable losses for clients; at the heart of it all, was a failed bet against the very pulse of America's financial lifeblood, with losses pegged between $30 million and $40 million, following what McDonald perceived to be impending market tumbles due to the pandemic and presidential election results that however did not happen, as detaailed by the U.S. Attorney's Office, Central District of California. Subsequent actions by McDonald suggested a desperate struggle to stay afloat, with a clumsy attempt to raise capital under the guise of launching a new mutual fund, but instead, this led to an alleged misappropriation of investor money including a substantial sum laid down at a Porsche dealership, say court documents.

There's also the ingestion of trust and funds as McDonald lured in nearly $675,000 from investors under the pretense of a single victim group only to scatter their money into personal expenses which included a luxury car purchase, three-piece suits, and upscale living arrangements. According to the same press release, the indictment also claims false account statements were distributed to ISA clients, another firm under McDonald's reign, which jeopardized clients' financial standings including one who lost the bulk of a $351,000 investment, further hampering their ability to make a down payment on a home.

If the court finds him guilty on all charges, the weight of justice could pin him down for decades, with each securities fraud and wire fraud count carrying a maximum penalty of 20 years, while other charges vary in potential incarceration lengths — illustrating a grim horizon for the former analyst, as reported by the U.S. Attorney's Office, Central District of California. The FBI and IRS Criminal Investigation leading the probe signal a stern warning to others in high finance: accountability extends to every tier. The case prosecution now rests with Assistant United States Attorney Alexander B. Schwab of the Corporate and Securities Fraud Strike Force.

-1.webp?w=1000&h=1000&fit=crop&crop:edges)