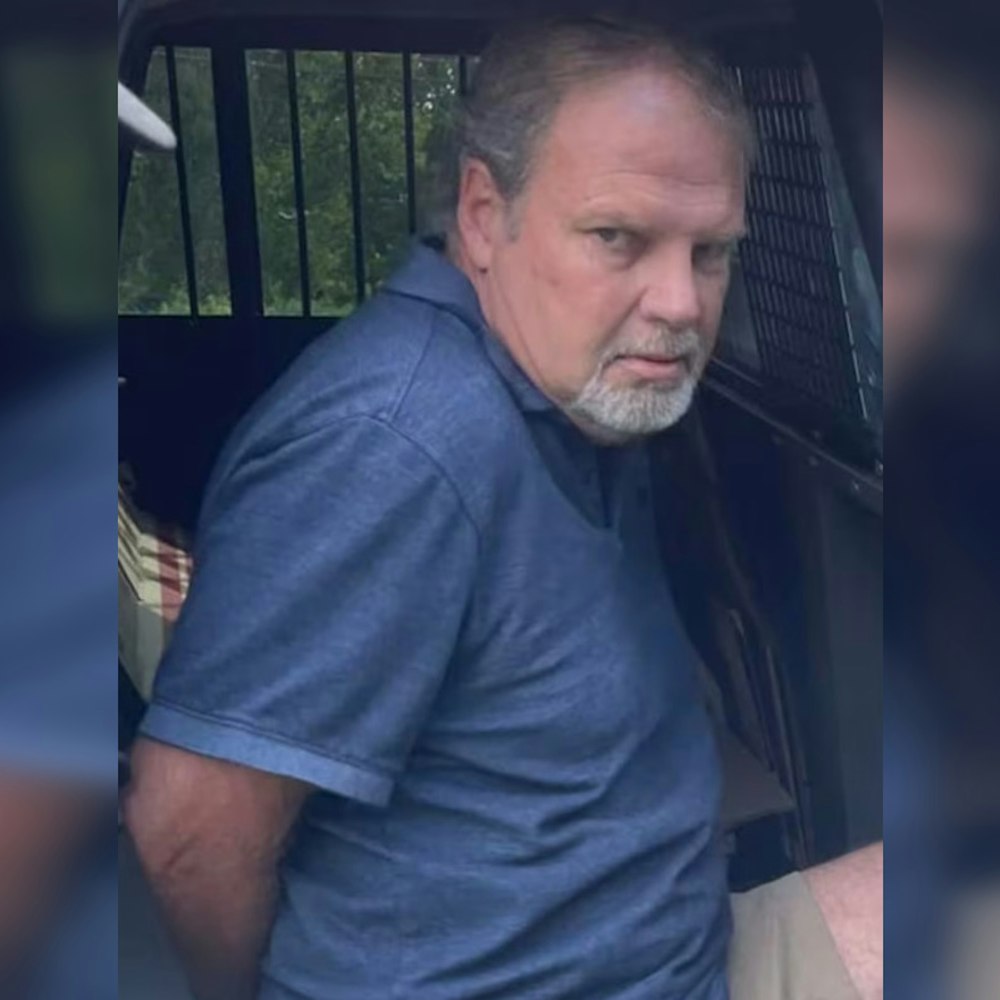

A former Massachusetts luxury homebuilder has been found guilty on charges of conspiracy to defraud the United States, as reported by the U.S. Attorney's Office for the District of Massachusetts. Jason Pecoy, 44, was involved in an elaborate scheme designed to evade taxes by concealing income and falsifying books during the construction of two luxury houses. The trial, which concluded with a conviction on June 7, spanned five days before U.S. District Court Judge Mark G. Mastroianni, who has now set the sentencing for September 12, 2024.

Acting U.S. Attorney Joshua S. Levy emphasized the gravity of the offense, stating, "Jason Pecoy was convicted for his role in an elaborate scheme with his father and Kevin Kennedy to defraud the United States by concealing money and maintaining false books, all so that Kennedy could avoid taxes for the construction of two luxury homes," Jason Pecoy decided that assisting in his father’s illegal efforts to support Kennedy’s greed was more important than following the law, this decision demonstrates a clear disregard for the law and a willingness to prioritize personal gain over ethical conduct.

Special Agent in Charge Harry T. Chavis Jr. of the Internal Revenue Service Criminal Investigation Boston Field Office also weighed in, pointing out the wider implications of tax evasion: “Pecoy made every effort to conceal his income from the IRS and evade paying his fair share of his taxes. Tax evasion is not a victimless crime, it impacts every American by stealing resources vital to maintaining public infrastructure and enhancing social welfare.”

Background information on the case reveals that Jason Pecoy, formerly associated with Kent Pecoy and Sons Construction Inc. (KPSC), along with his father Kent Pecoy, and one Kevin M. Kennedy, who had a history in golf management, conspired to obstruct the IRS from 2009 through 2016, they did this by handling large sums of cash off the books and by making structured deposits to evade detection and they further obscured these transactions with falsified accounting records and dual bookkeeping. Kennedy, who was previously convicted and sentenced for related charges, directly engaged with the Pecoys to escape his tax obligations on the construction of his East Longmeadow and West Dennis homes, according to the same source.

The charges against Jason Pecoy carry a sentencing potential of up to five years in prison, a period of three years of supervised release, and a fine of up to $250,000. The cases are being prosecuted by Assistant U.S. Attorneys Steven H. Breslow and Neil L. Desroches of the Springfield Branch Office, in collaboration with Trial Attorney Eric B. Powers of the Justice Department’s Tax Division.

-1.webp?w=1000&h=1000&fit=crop&crop:edges)