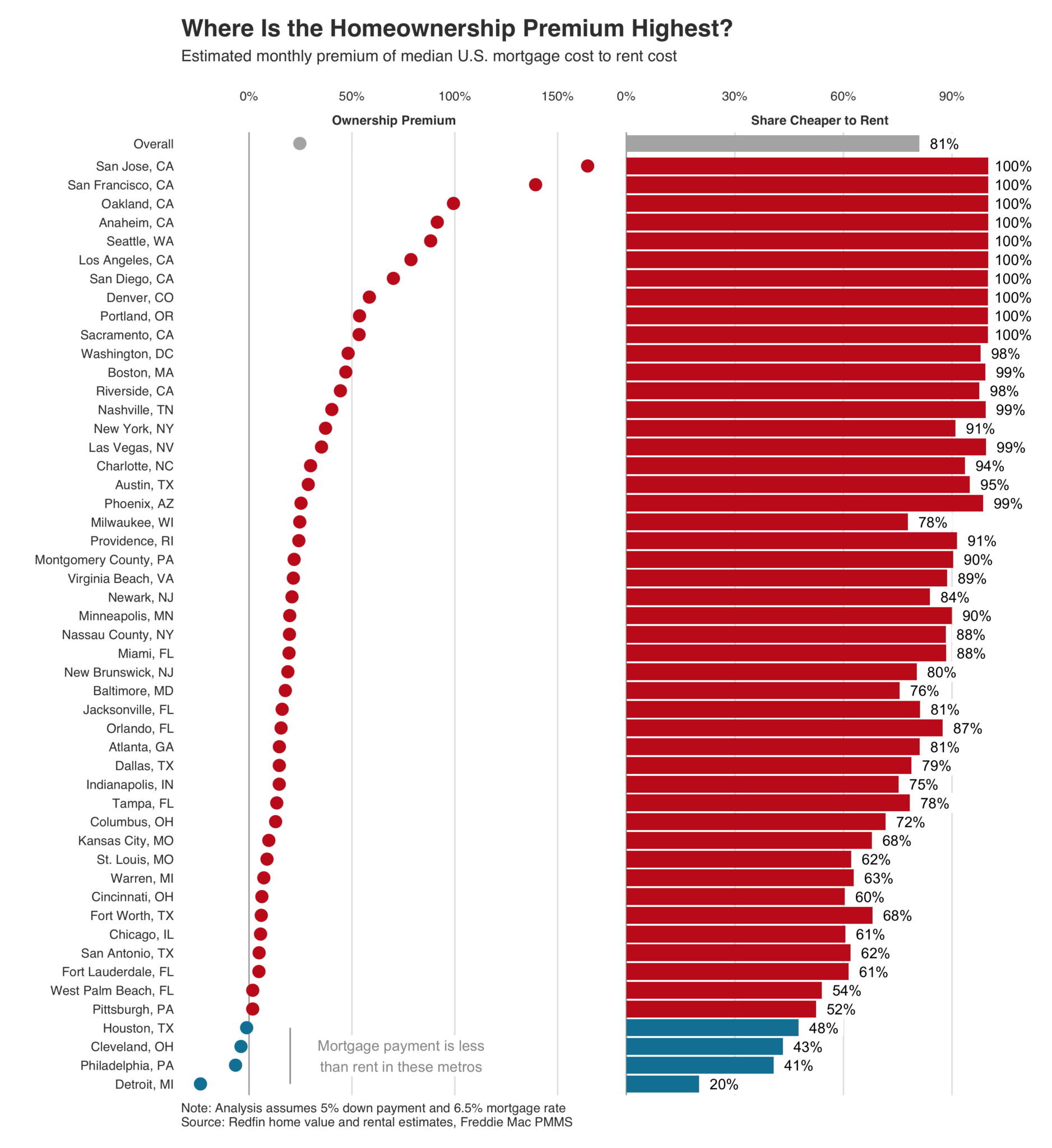

With the soaring cost of living, many people are wondering whether buying a home in the U.S. makes more financial sense than renting. While this may be true for some parts of the country, it is certainly not the case for San Jose, California, where owning a home costs a staggering 165% more than renting, according to a recent Redfin report.

(Source: Redfin)

(Source: Redfin)

This massive premium presents a challenging dilemma for potential homebuyers in this tech industry hub, where owning a home means a median estimated monthly mortgage payment of $11,049, compared with a median estimated monthly rent of $4,176. In fact, San Jose takes the crown for the largest homeownership premium among the 50 most populous metropolitan areas in the U.S. It should come as no surprise that other high-priced cities in California, such as San Francisco and Oakland, are following closely behind, with ownership premiums of 139% and 99% respectively, as DSNews reports.

But the perceived benefits of owning a home—as Redfin Deputy Chief Economist Taylor Marr explains—revolve around building equity, and when the cost of homeownership is so significantly greater than renting, many people simply choose the more financially feasible option: renting. On a national level, the typical home costs an estimated 25% more per month to own than rent, with an estimated monthly mortgage payment of $3,385 and an estimated rent of $2,715.

While San Jose may top the list for homeownership premiums, other major U.S. metropolitan areas offer a completely opposite scenario, where homeownership is actually cheaper than renting. Cities like Detroit, Philadelphia, Cleveland, and Houston offer more affordable options for homeowners, with Detroit leading the pack at a 24% discount for ownership compared to renting, as both Redfin informed us earlier this year.

However, these statistics might change if mortgage rates were to drop. The current 25% nationwide homeownership premium could shrink significantly if mortgage rates were to fall to 5%, as Redfin's analysis suggests. In this scenario, buying the typical home would only cost an estimated 10% more than renting it. If rates dipped to 4%, the premium would shrink to just 1%, and if they fell to 3%, it would actually become 7% cheaper to rent. Unfortunately, as Marr explains, the likelihood of mortgage rates returning to 3% levels anytime soon is highly unlikely.

As the debate between renting and buying continues, it is essential to consider the local market conditions and one's individual financial situation. Yes, homeownership has its perks, such as wealth-building opportunities, fixed monthly costs, and tax benefits. However, it may not be the best option for everyone, especially in cities with such high homeownership premiums as San Jose and other pricey coastal markets.

Additionally, it is important to consider the consequences of the recent pandemic, which has led to skyrocketing home prices and declining affordability in once relatively affordable cities like Sacramento, Las Vegas, Phoenix, and Austin—all popular migration destinations during the pandemic, as another Redfin article mentioned. With virtually no homes cheaper to buy than rent in these cities, potential homebuyers must carefully evaluate their options before making such a hefty investment in the current volatile housing market.