The San Francisco County Transportation Authority’s first long-term bond sale, offering $248.25 million in sales tax revenue bonds, closes on November 2.

Proceeds will fund major transportation projects already underway, CTA spokesman Eric Young told us, “meaning they are under contract and expected to be completed within the next few years.”

The projects expected to be funded through the bond sale include the purchase of new buses, trolleys, and light-rail vehicles, as well as radio replacements for SFMTA, Young said.

The CTA serves as the city's transportation sales tax administrator and accrues a half-cent from the city's sales tax for transportation improvement and maintenance projects.

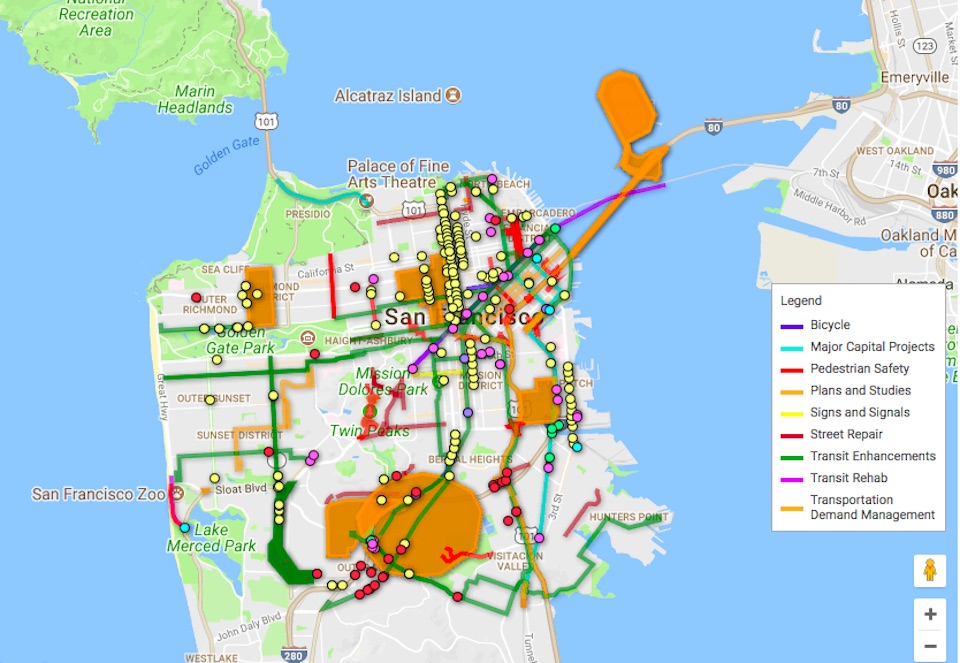

The half-cent tax originated in 1990 and was superseded by Proposition K in 2003 after voters approved efforts to raise funds for a wide range of transportation improvements, from replacing traffic signals to repaving transit routes.

The projects to be funded through the bond sale are included in the Proposition K expenditure plan, said Young.

CTA has already spent more than $2.8 billion in sales tax revenue to fund voter-approved projects such as the Presidio Parkway, Central Subway, and Transbay Transit Center, according to the agency. The sales tax also helps support new crosswalks, bike lanes, and vehicles such as buses and trains for the light rail and BART systems.

As we recently reported, Muni is rolling out new light-rail vehicles by the end of this year, and BART plans to start putting new railcars in service by the end of November.

Prior to the bond sale, the two largest credit rating agencies raised CTA’s rating, which helped boost investor interest, according to the agency. The city's growing population and associated increasing wealth make it an attractive investment, the agency said in a press release.

Bank of America was selected out of five firms that bid to underwrite the bonds, because it offered the lowest average cost to borrow, according to CTA. The agency will use Proposition K monies to repay the bonds over 17 years.

The long-term bond was deemed necessary to provide funding for the large-scale, near-term improvements needed to the city's public transit system, according to CTA.

“The Transportation Authority is pleased to help deliver critically needed Muni vehicles and other citywide transportation improvements through the sale of our first long-term bond,” CTA chair and District 3 Supervisor Aaron Peskin said in a statement.