![Castro real estate office set to be demolished and replaced with 6-story, 14-unit condo building [Updated]](https://img.hoodline.com/2022/8/2201market_rendering_1-5.webp?max-h=442&w=760&fit=crop&crop=faces,center)

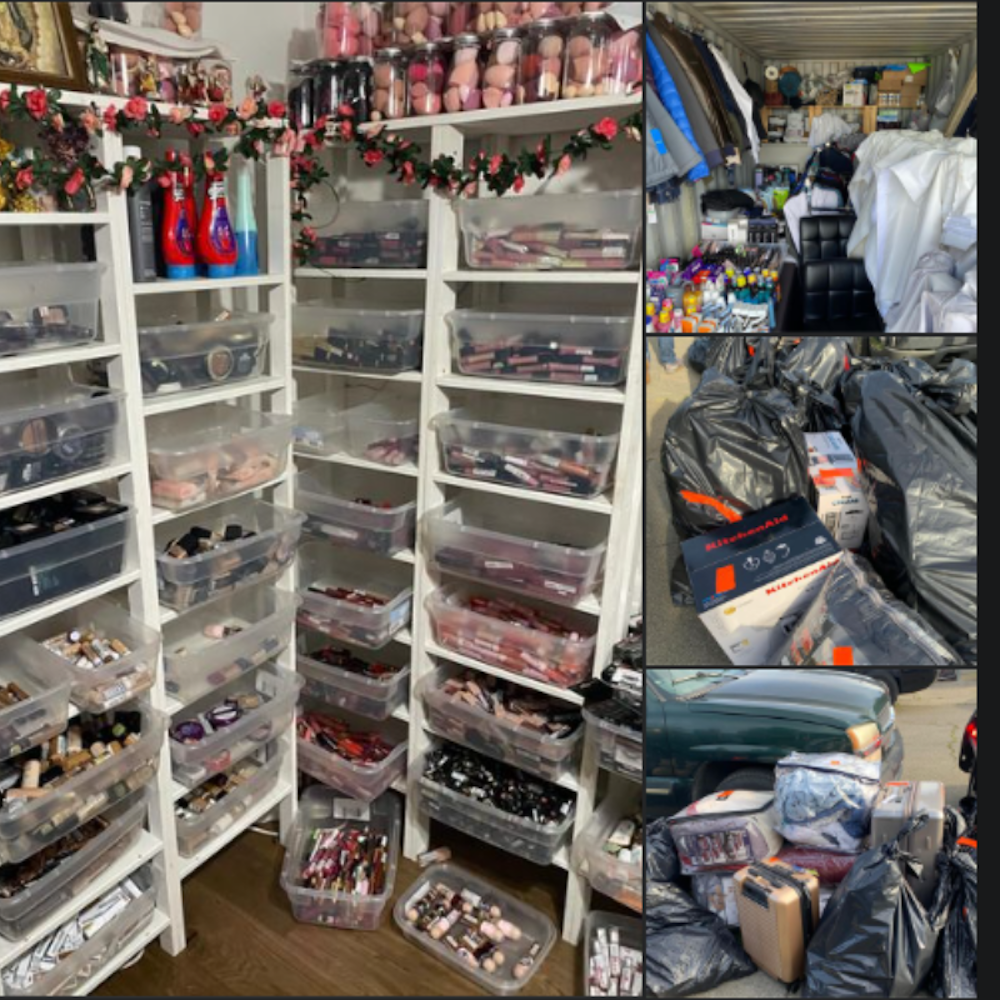

Nearly six years after receiving approval, a former real estate office at 2201 Market St. (at Sanchez) will be demolished and replaced with a six-story mixed-use building.

Fences recently went up around the triangular property that was the former Muscat Realty, indicating that demolition work may soon begin. Hoodline reached out to project developer Polaris Pacific for a timeline but did not receive a response.

In its place, a 65-foot-tall mixed-use building with 14 market-rate condominiums will be built. The building will contain approximately 2,650 square feet of ground floor retail, underground parking for six vehicles, and 14 Class 1 bicycle parking spaces.

Hoodline first reported on the project designed by Edmonds and Lee Architects, Inc. in 2014. Longtime Castro residents will recall that Starbucks had proposed taking over the corner location in 2012, but those plans were ultimately rejected by SF Planning.

The two-story building at 2201 Market St. is slated for demolition. | Photo: Steven Bracco/Hoodline

SF Planning approved the project in November 2016, after a discretionary review filed by the Duboce Triangle Neighborhood Association (DTNA) was withdrawn. DTNA and the project's developers agreed to a memorandum of understanding on four key issues.

At issue for DTNA was a proposed design that included a corner overhang. DTNA stated in its Discretionary Review application that “an unenclosed corner at ground level would invite tagging, transients, and present a security problem, as it's visually blocking the space.”

Chris Foley, a partner at Polaris Pacific and Historic Preservation Commission board member, agreed to enclose the area in question. Foley did not respond to Hoodline's request for comment.

DTNA’s second point of contention was with the development’s mandated 12 percent below-market-rate housing, which would work out to two of its 14 units if they are built on-site.

DTNA requested that Polaris provide the mandated two units of affordable housing on-site, or at the very least, in the neighborhood. “The number of affordable housing units has disappeared in the neighborhood,” said DTNA land use chair Gary Weiss in 2016. “We want those two units on-site.”

Planning spokesperson Gina Simi explained that since the development had only 14 units total, the project was subject to 12 percent on-site affordable units. “Increased below-market-rate requirements only apply to projects with 25 or more units,” wrote Simi.

Image: Edmonds and Lee Architects, Inc.

Polaris will be required to either build the units on-site, build them at another site in San Francisco, or elect to pay the city’s in-lieu fee, which goes into developing affordable housing in the city.

SF Planning's Dan Sider tells Hoodline that Polaris has paid a $741,358.01 affordable housing fee. "That strongly suggests that the developer is fee-ing out entirely," said Sider.

"In order to get 100% certainty that they’re not doing a combination of fee and on/off-site, we’d have to track down the physical permit and plans and associated application package that I believe is currently somewhere deep in the bowels of DBI," added Sider.

Hoodline has reached out to the Department of Building Inspection for comment.

Photo: Steven Bracco/Hoodline

Polaris also agreed to split the large ground-floor commercial space into two smaller spaces to attract businesses. The developer also agreed to allow all tenants access to the roof, unlike previous renderings, which only provided roof access to the building's penthouses.

Public records indicate the housing development will cost approximately $5.6 million to construct. A demolition permit was approved in October 2014 and construction costs are estimated at $35,000.

Since being issued, the demolition permit has been extended five times for a fee total of $1,386. The permit will expire on March 27, 2023. The notes state, "this is the final extension."

In 2019, a canopy that extended over the building's parking area that had fallen into disrepair was removed at an estimated cost of $6,000.

A canopy over the parking area was removed in 2019. | Photo: Steven Bracco/Hoodline

The project joins a handful of proposed or already completed residential construction along the Upper Market corridor.

Across the street at 2200 Market St., now arcade bar and restaurant Detour, a five-story, 22-unit mixed-use residential building was built in 2012. In 2016, The Duboce debuted at 181 Sanchez (at Market).

Additionally, a 44-unit condo building at 2238 Market Street by the Prado Group Inc. was completed earlier this year.

In the Market and Church area, a 30-unit complex at 2135 Market Street has been proposed at the former Old Bible Church. A seven-story, 24-unit mixed-use building has been proposed at the former Sparky's Diner site at 240-250 Church Street.

At 2140 Market St., popular dive bar Lucky 13 closed in 2020, making way for a proposed five-story, 28-unit apartment building that has not yet started construction.

Earlier this year, a seven-story, 29-unit mixed-use condominium building was proposed at 2051 Market St., formerly Eros bathhouse.

The controversial seven-story, 60-unit building at the former Home Restaurant at 2100 Market Street opened in 2019.

Hoodline readers may recall that Sonder, a San Francisco-based startup specializing in furnished apartment rentals, and building developer Brian Spiers, faced criticism for allotting all 52 of the building's market-rate housing units to medium-term rentals of a month or more. Eight of the units were set aside as below-market-rate (BMR) apartments.

Update, September 7:

San Francisco Department of Building Inspection spokesperson Patrick Hannan confirmed that there will be no affordable housing units built on-site. "The owners of this property paid the full fee for their affordable housing requirement," said Hannan. "There will be no on-site below-market-rate units."